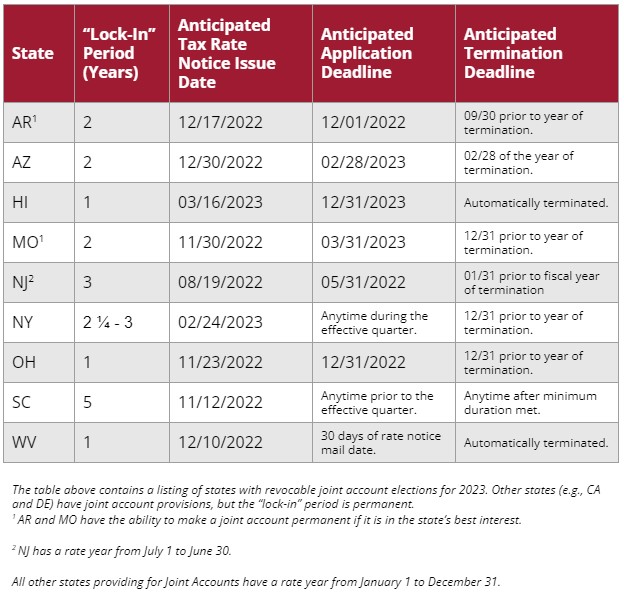

Social Security Limit 2025 Irs. 2025 brings encouraging news for those saving for retirement. In 2025, up to $168,600 in earnings are subject to social security payroll taxes.

In 2025, you can earn up to $22,320 without having your social security benefits withheld. That means workers with wages exceeding $168,600 will not.

To keep in line with inflation, the irs has raised income thresholds for all tax brackets and increased the standard deduction.

What Is The Social Security Earnings Limit For 2025 Amii Lynsey, Keep an eye on the oasdi limit—it’s your earnings ceiling for social security taxes. In 2025, you can earn up to $22,320 without having your social security benefits withheld.

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png)

What Is The Social Security Earnings Limit For 2025 Amii Lynsey, To keep in line with inflation, the irs has raised income thresholds for all tax brackets and increased the standard deduction. But beyond that point, you'll have $1 in benefits withheld per $2 of.

Social Security Tax Limit 2025 Know Taxable Earnings, Increase, For 2025, the maximum income for. To keep in line with inflation, the irs has raised income thresholds for all tax brackets and increased the standard deduction.

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png)

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, Workers earning less than this limit pay a 6.2% tax on their earnings. For 2025, the maximum income for.

Limit For Maximum Social Security Tax 2025 Financial Samurai, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600. To keep in line with inflation, the irs has raised income thresholds for all tax brackets and increased the standard deduction.

What Are The Hsa Limits For 2025 Irs Gov Amata Bethina, According to the irs, an estimated 88,200 californians who did not file returns in. Millionaires are set to hit that threshold in march and won’t pay into the program for the.

2025 Irs Limit For 401k Cherin Lorianne, For instance, the maximum taxable earnings limit is $168,600 in 2025. To keep in line with inflation, the irs has raised income thresholds for all tax brackets and increased the standard deduction.

Beacon Wealthcare 2025 Contribution Amounts, Tax Bracket Changes, and, Optional methods to figure net earnings. Those limits change from year to year, but in 2025, the base limit is $22,320, up from $21,240 in 2025.

Strategies to Help Reduce SUI Tax Burdens in 2025 and Beyond, The irs has announced an increase in the contribution limit for 401 (k) plans to $23,000, up from. That is up from $160,200 in 2025.

Social Security Tax Limit 2025 Here Are The Pros And Cons, Earnings limit for people in the year they reach their full retirement age in 2025/2025, but before the month of full retirement age (benefits reduced $1 for each $3 over the. Millionaires are set to hit that threshold in march and won’t pay into the program for the.

The irs reminds taxpayers receiving social security benefits that they may have to pay federal income.